Why has Scott Stringer Invested City Pensions in Private Equity Firms like Blackstone?

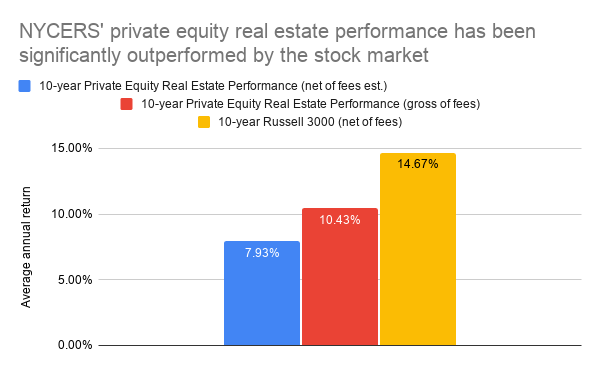

City pension fund investments in private equity real estate haven’t just subsidized rent hikes and evictions. They’ve also cost the city at least $370 million.

No state pursues workers for overpaid unemployment benefits as aggressively as New York. A proposed reform is colliding with New York’s own repayment problem.

A quarter of lawmakers in Albany are landlords. Almost none of them are covered by the most significant tenant protection law in years.

It’s the first step New York has taken to address its housing shortage in years — but tenant groups are fuming and real estate wants more.

After the governor declined to answer questions, a New York Focus reporter was ejected from her event.

The constant gridlock is a major drag on Manhattan’s businesses, and source of frustration for commuters. And it’s never been so bad.

Lawsuits had threatened to kill congestion pricing. Now, it might take a lawsuit to save it.